Preferred Risk Flood Insurance

Even if you live outside a high-risk flood zone – and you think you don’t need flood insurance – think again.

Van Beurden Insurance is extremely concerned about an increase of flooding in California. We request our policyholders to either select or decline flood coverage immediately.

If you do not wish to purchase flood insurance, please complete this form and return:

Fax: (530) 661-9032

Email: aniek@vanbeurden.com

Mail: Van Beurden Insurance Services, Inc.

PO Box 2053

Woodland, CA 95776-2053

Re-think your flood insurance decision …

Preferred Risk Policies offered through the National Flood Insurance Program offer lower premiums for homes, residential buildings and even condo unit owners located in the low to moderate risk zones (B, C, or X zones). The average flood claim amounts to $33,000 while the premium for a residential Preferred Risk Policy is not more than $500 per year.

Why you need Flood Insurance

- Floods are the most common natural disaster.

- Standard Homeowners policies do not cover flood damage.

- Floods happen everywhere. In all 50 states and in your neighborhood.

- Common causes of flooding include: rapid rainfall, spring snowmelt, changing weather patterns, clogged rainwater systems, new building development and even drought or wildfire conditions.

- More than 25% of floods happen in low to moderate risk flood zones.

- Government assistance is only available in less than half of all floods, and it usually comes in the form of a loan – repayable with interest.

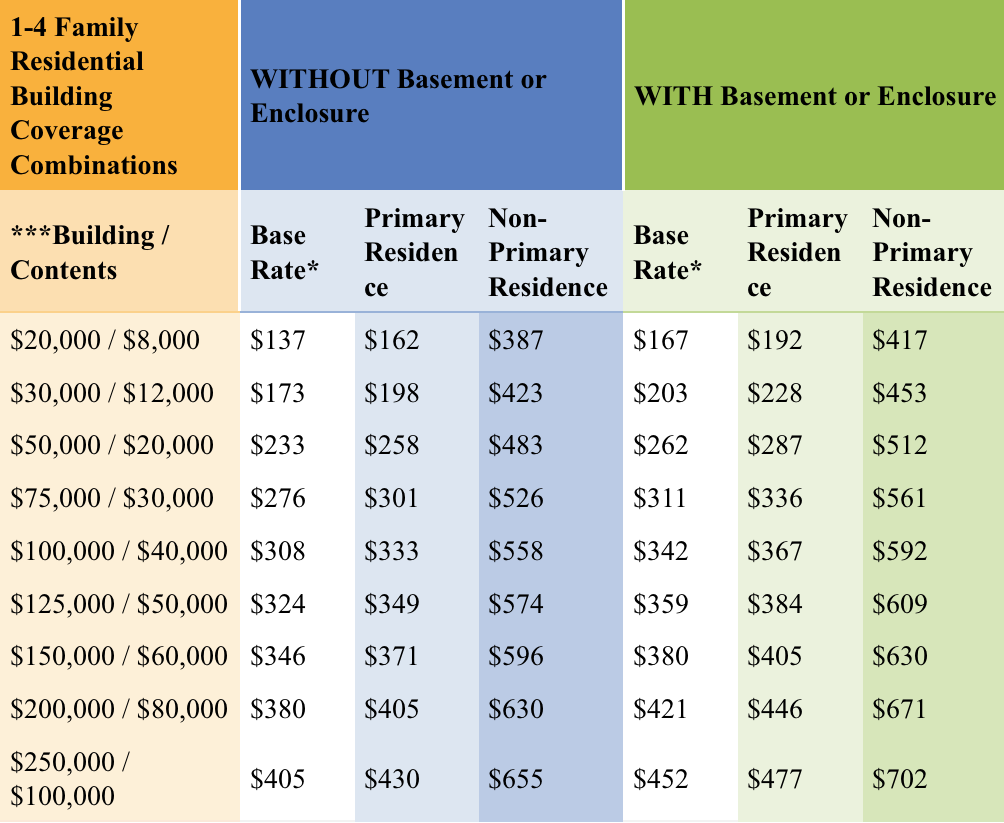

How Much Will it Cost?

**Preferred Risk Policy Coverage with NFIP and Premiums Effective April 1, 2015

*In accordance with the Homeowner Flood Insurance Affordability Act (HIFAA), a surcharge of $25.00 or $250.00 must be included based on type, and occupancy of the building. Your agent can help explain building type, usage and rates.

** Not all property owners will qualify for PRP. Additional eligibility requirements may apply. New policies are subject to a 30 day waiting period following receipt of payment.

***Additional coverage options for Flood Coverage in Excess of these limits may be available. Contact us today for more information.

If you do not wish to purchase flood insurance, please complete this form and return:

Fax: (530) 661-9032

Email: aniek@vanbeurden.com

Mail: Van Beurden Insurance Services, Inc.

Post Office Box 2053

Woodland, CA 95776-2053

Select a Sales Associate specializing in Flood Insurance solutions.