How Our Risk Assessment Uncovered, Corrected Multiple Costly Risks

I recently met with a new prospect who agreed to go through my Risk Assessment Process — the prospect is now my client.

Our risk assessment process is meant to uncover risks and threats our new accounts potentially face and may not even be aware they have. During this specific meeting we uncovered multiple risks the insured was not even aware of and due to that I felt it’s a good example of what our process uncovers.

I’ll call the client ABC Contractor.

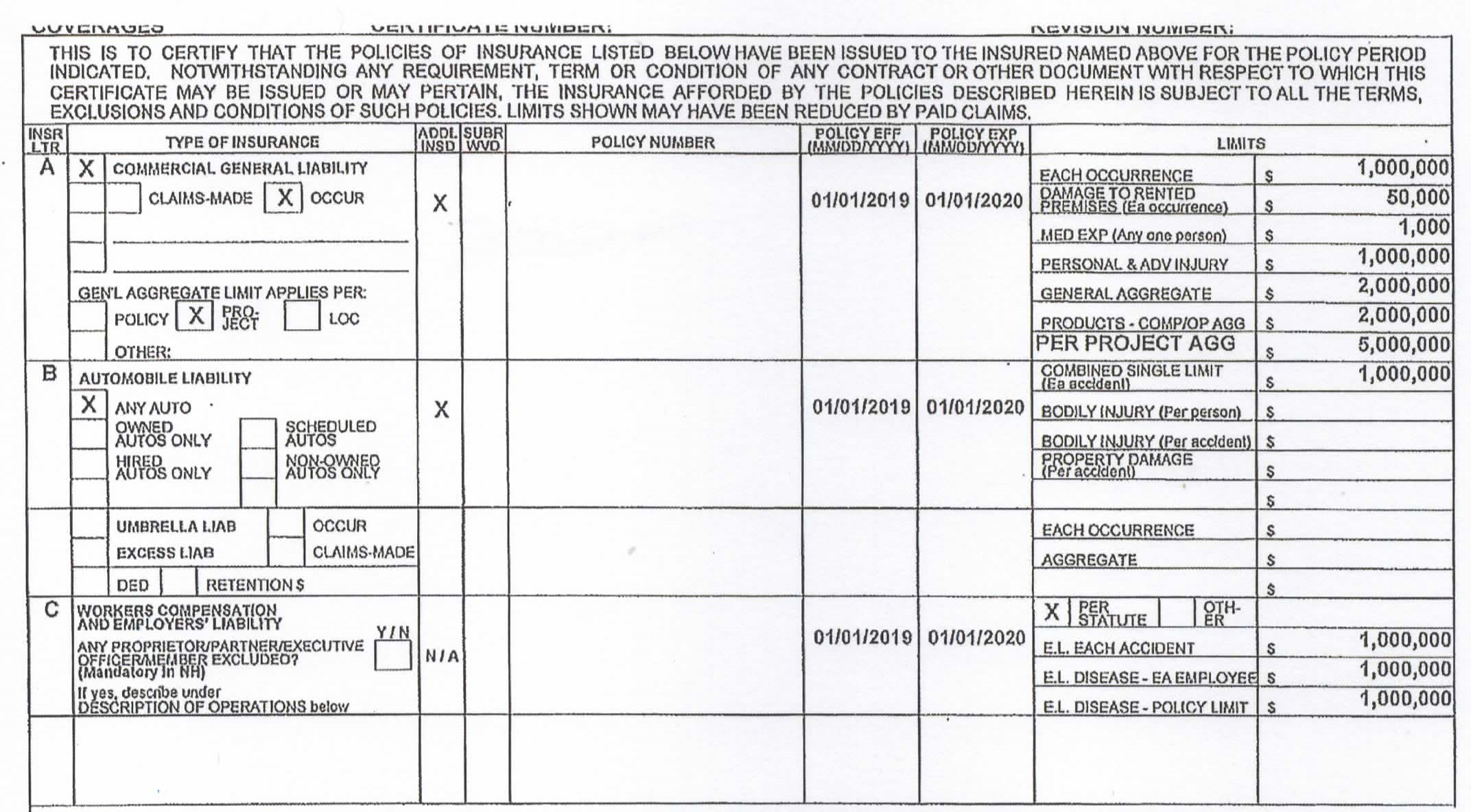

ABC is a large Contractor in California, they bid and work on roughly 85% commercial risks such as large grocery stores, clothing stores…etc. Due to this they require specific coverage limits to meet their contract obligations. While reviewing the previous certificate of insurance, we uncovered a large error. The previous brokerage firm unfortunately provided a certificate of insurance for roughly 75 certificate holders with EACH certificate showing a limit of insurance of $5,000,000 of a Per Project Aggregate. Normally this would be a good business practice, but there is a MAJOR issue with this. The specific insurance carrier the insured had coverage with is NOT able to offer a $5,000,000 aggregate limit and furthermore, the insured did NOT have that coverage on their policy. We even found out the highest the insureds policy and insurance carrier could offer on the General Liability policy was $2,000,000 General Aggregate.

The potential legal issues can have a large negative financial impact on this account.

I feel it’s important for my prospects are aware of the contracts and risks they get involved with. Overall our client now has correct coverages, we helped re-issue certificates and now have obtained correct coverages. Please contact me so we can have a risk assessment meeting with your company! I can assure you valuable information will come from this meeting.